Tokenization 101

Learn about Real Estate Tokenization!

What Tokenization Means

Definition: Tokenization is the process of issuing a blockchain token (security token) that digitally and legally represents a real asset.

Just a few Benefits of Tokenization

Efficiency – time & cost (x10 reduction):

– Digitization and automation of processes

– Automated compliance and governance

– Removal of human errors

New capabilities:

– Increased liquidity (from 0 to 1)

– Fractional ownership / democratization

Other values:

– Global standards and interoperability

– Logging of transactions

– Factor x10 increased design space

token custody solution with a custody provider and choose the right blockchain

network for token creation.

types of shareholders, and the relevant regulations.

token custody solution with a custody provider and choose the right blockchain

network for token creation.

DigiShares Platform

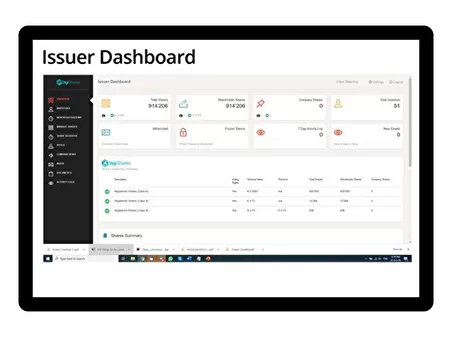

Issuance

- Investor registration and verification (KYC / AML)

- Token purchase

- Electronic document workflow and signatures

Corporate Management

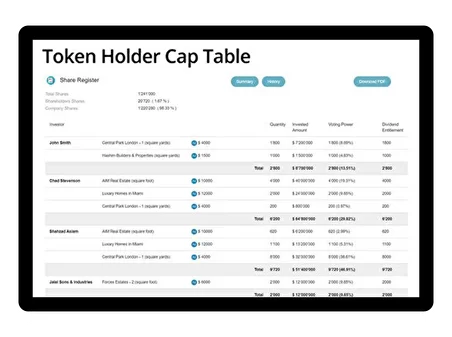

- Tokenized shareholder register over multiple share classes

- Investor communication & voting

- Dividends

- Freeze / renewal of tokens

Trading

- Internal exchange

- Integration to custodians, banks and payment platforms

Tokenize Your Company Today

DigiShares provides a software solution that is used throughout the issuance process but also later, for the ongoing corporate management of the tokenized shares, as well as the subsequent trading.

Once the issuance is completed, the platform maintains the share cap table and enables the issuer to whitelist new investors who are interested in buying shares. DigiShares helps with the initial design of the security token such that it fulfills regulatory requirements.

DigiShares uses the most popular security token protocols and helps ensure that the token may later be traded on forthcoming security token exchanges. DigiShares is your trusted partner to ensure that your digital shares will be compliant and liquid.

Contact us to learn more about tokenization

By submitting our contact form you agree to receive follow-up email communication.