PROGRAM

All times in EDT (Eastern Daylight Time)

9.00 am – Welcome & Introduction

Mette Kibsgaard, CMO, DigiShares

9.05 am – Tokenization Industry Status Update and DigiShares Traction

Claus Skaaning, CEO, DigiShares

9.15 am – Multi-Token Approach to Real Estate Tokenization

Mohammed Mahfoudh, CEO & Founder, Deca4 Advisory

9.30 am – 2140 Consulting: End-to-End STO Consulting. What Does It Mean and What To Expect?

Maarten Van Doorslaer, Partner, 2140 Consulting

9.45 am – Tokenization End-to-End Consultancy

David Ramirez, Head of Business Development, Shift Markets

10.00 am – How Tokenization Enables Foreign Access to Real Estate

Herwig Konings, Founding Partner and CEO, Security Token Group

10.15 am – Newblock – The Future is Now: Traditional Real Estate with Innovative Technology

Eli Tilson, Head of Real Estate Investments, Porat

10.30 am – Case Study: High Circle Ventures

Hemanth Golla, Founder, High Circle Ventures

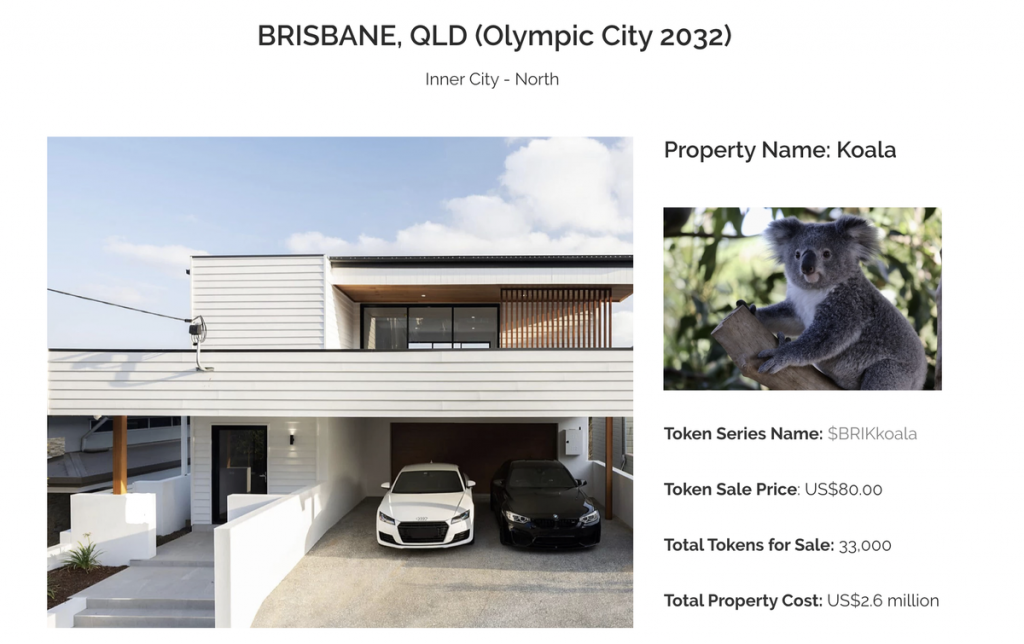

10.45 am – Case Study: BRIKbc Projects – Our Brikbc Journey

Luis Miguel Aleixo; MD & Co-Founder, FCPA, MAICD & FAIM; BRIKbc Projects Pty Ltd

11.00 am – Fireside Chat & AMA

All times in EDT (Eastern Daylight Time)

9.00 am – Welcome & Introduction

Mette Kibsgaard, CMO, DigiShares

9.05 am – Tokenization Industry Status Update and DigiShares Traction

Claus Skaaning, CEO, DigiShares

9.15 am – Multi-Token Approach to Real Estate Tokenization

Mohammed Mahfoudh, CEO & Founder, Deca4 Advisory

9.30 am – 2140 Consulting: End-to-End STO Consulting. What Does It Mean and What To Expect?

Maarten Van Doorslaer, Partner, 2140 Consulting

9.45 am – Tokenization End-to-End Consultancy

David Ramirez, Head of Business Development, Shift Markets

10.00 am – How Tokenization Enables Foreign Access to Real Estate

Herwig Konings, Founding Partner and CEO, Security Token Group

10.15 am – Newblock – The Future is Now: Traditional Real Estate with Innovative Technology

Eli Tilson, Head of Real Estate Investments, Porat

10.30 am – Case Study: High Circle Ventures

Hemanth Golla, Founder, High Circle Ventures

10.45 am – Case Study: BRIKbc Projects – Our Brikbc Journey

Luis Miguel Aleixo; MD & Co-Founder, FCPA, MAICD & FAIM; BRIKbc Projects Pty Ltd

11.00 am – Fireside Chat & AMA

Webinar

Date

February 16, 2022

Date

February 16, 2022

Full Webinar